United States, United Kingdom, Australia rank as world’s most transparent real estate markets

MIST markets among leading improvers

African, Middle Eastern, Latin American markets lag

A biennial index released today by Jones Lang LaSalle and LaSalle Investment Management (NYSE:JLL) reveals that recovering real estate markets have prompted renewed impetus to transparency improvements following a slowdown in progress during the financial crisis in 2008 and 2009. Nearly 90% of markets have registered advances in real estate transparency during the past two years, driven by improving market fundamentals data and performance measurement, combined with better governance of listed vehicles.

The 2012 Global Real Estate Transparency Index, a proprietary Jones Lang LaSalle survey that calculates transparency in 97 real estate markets worldwide by weighting 83 different factors, provides investors and corporate occupiers with data and analysis critical to transacting, owning and operating in global markets. The Index also assists governments and other industry organizations interested in improving transparency.

Key Findings:

- The United States ranks as the world’s most transparent real estate market in 2012, followed closely by the United Kingdom and Australia. Also in the ‘Highly Transparent’ category: Netherlands, New Zealand, Canada, France, Finland, Sweden and Switzerland. The Index reaffirms the ascent of the MIST growth markets (Mexico, Indonesia, South Korea and Turkey), which all feature among the leading improvers. Turkey once again leads in transparency improvement.

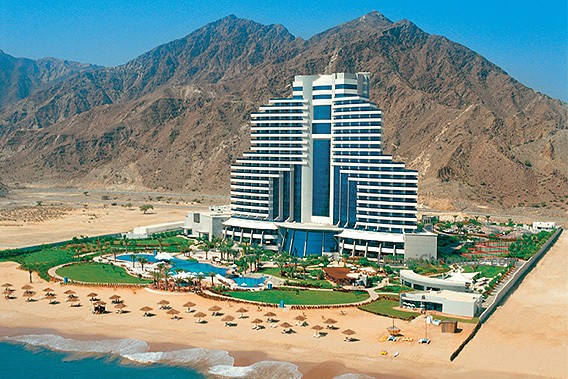

- Environmental sustainability has emerged as an important transparency factor with the United Kingdom, Australia and France the most transparent markets in terms of real estate sustainability. The UK has a long history of building energy efficiency systems and introduced the world’s first Green Building rating system. Australia has been the test bed for new environmental laws, regulations and incentives. Dubai scores less well than other major global cities in respect of the transparency of sustainability related issues.

- The 2012 Index highlights continued transparency deficiencies in many African, Middle Eastern and Latin American markets. Nations scoring the lowest on transparency, the so-called opaque markets, include Sudan, Nigeria, Ghana, Iraq, Pakistan and Algeria.

- While transparency has improved in 80% of the markets across MENA over the past two years, these gains have been relatively modest and real estate markets in MENA remain less transparent than other global regions. Dubai remains the region’s most transparent market but achieves only a middle ranking in global terms (47 of 97 markets covered globally), while Lebanon has shown the greatest improvement over the past 2 years.

Commenting on the findings of the index for the Middle East & North Africa region, Craig Plumb, Head of Research for Jones Lang LaSalle MENA noted that:

“More needs to be done to increase the level of transparency of the market both in Dubai and across the broader region, particularly in respect of investment performance indicators and data on market fundamentals. The lack of progress on these areas in recent years has contributed to the low level of investment activity and the oversupply that is currently being experienced in some sectors of the market.

We expect to see more improvement in transparency over the next few years as policy makers recognise this will attract greater demand from overseas investors and occupiers familiar with higher levels of transparency and market information. The increased focus on sustainability is also likely to result in higher levels of transparency and disclosure.”

Transparency Drivers:

The report identifies four main forces that are expected to drive further progress in transparency through the next update in 2014:

- The growing recognition in many emerging economies, such as the Middle East and North Africa, that the current lack of performance indicators and accurate market information is hindering inward investment and hampering the development of competitive domestic real estate sectors.

- The ongoing credit and sovereign wealth crises, particularly in Europe, will motivate regulators, central banks, foreign investors and other real estate professionals towards better transparency, in the process offering more public data on real estate debt and monitoring lenders more closely.

- As recent corruption scandals come to light (often involving the permit process for commercial real estate development), governments will pay closer attention to the circumstances that engender under-the-table payments.

- The role of properties’ sustainability characteristics will play an increasing role in leasing and investment decisions, growing from a marginal criterion to a critical decision-making input. Such concerns will force greater transparency of energy efficiency and Green Building benchmarking.

Middle East and Africa:

While some improvements have been recorded since 2010, the Middle East and Africa remains the least transparent of the 4 global regions covered in the Index. Areas where the MEA region scores particularly poorly include the lack of investment performances indices and the lack of available data on market fundamentals.

Within the MEA region, there is a wide variation in terms of transparency. South Africa is the most transparent market, sharing many of the same characteristics as the Anglophone markets such as the US, the UK and Australia which top the global list of most transparent markets. Dubai is the second most transparent market within MEA and the most transparent within the MENA region. Among the areas that Dubai scores most strongly are its regulatory framework, with RERA (the Real Estate Regulatory Authority) widely acknowledged to be the market leader within the region and the DIFC (Dubai International Financial centre) which is emerging as the vehicle of choice for listed real estate funds.

Lebanon has seen the greatest improvement in transparency within the MENA region over the past 2 years, although this market is currently experiencing some instability due to events in neighbouring Syria. The strong performance of the Beirut market has attracted greater interest from overseas investors and has led to a greater awareness and more market data becoming available. The creation of the Real Estate Association of Lebanon and stricter controls on lending by the Central Bank have also contributed to the improvement in transparency.

At the other extreme, eight of the eleven opaque markets globally are found in the MEA region. While current levels of transparency remains poor in markets such as Sudan, Pakistan, Iraq and Algeria, there is increased interest from international corporate occupiers in these emerging markets and this is likely to result in an improvement in transparency levels over the next few years.

Real Estate Sustainability Transparency Index:

In recognition of the increasing relevance of environmental sustainability in real estate decisions, the 2012 Index includes a separate Real Estate Sustainability Transparency Index for a sub-set of 28 countries, covering issues such as energy efficiency benchmarking and green building rating systems. The United Kingdom, Australia and France have emerged as the most transparent markets in terms of real estate sustainability while Dubai is one of the lowest.

The 2012 results also reaffirm the relationship between real estate investment volumes and transparency. Rising levels of transparency are associated with higher levels of foreign direct real estate investment, a powerful incentive for encouraging the free flow of information as well as the fair and consistent application of local property laws. The world’s fastest-growing direct commercial real estate investment markets during the past two years – such as Brazil, Turkey, Indonesia and Vietnam – are all among the world’s top 10 transparency improvers.