Better-than-expected economic recovery in the US lowered the investors’ appetite for bonds. This favored the demand for risky assets. Global investors now prefer to place their assets in equities. Also, four years of quantitative easing brought a strong supply of liquidity. Therefore, now money is not pouring into gold any longer, but in real estate or equity.

More and more large-scale fund houses are reducing their gold holdings. This is a bearish indicator for gold. The 2012 yellow metal demand hit a record of $236.4 billion. Yet, in terms of tonnage it fell by 4% to 4,405.5 tons on year over year basis.

Recently, a number of major financial firms have been cutting their 2013 gold forecasts. This suggests that the bullish run for gold may finally be over as governments across the world review their stimulus programmes.

In February, investors sold 106.2 metric tons worth $5.4 billion from exchange-traded products. This is the highest level since ETF creation in 2003.

With a stronger dollar, gold continues to trade around $1,600 per ounce worldwide. As a consequence of that, the equity markets are becoming more stable. Additionally, the weak physical demand and low investor interest put more pressure on the gold bullion market.

Meanwhile, private investors are turning away from government bonds. Now they are showing improved interest for prime real estate in key markets, as it promises better returns on investment. There is a growing number of market players seeing real estate once again as the most ideal safe haven market.

Currently, property accounts for the largest share of high net worth individuals (HNIs’) investments portfolios. Globally it averages at 22%, while gold stands at 18%. Meanwhile, equities reached to 15% of the portfolio.

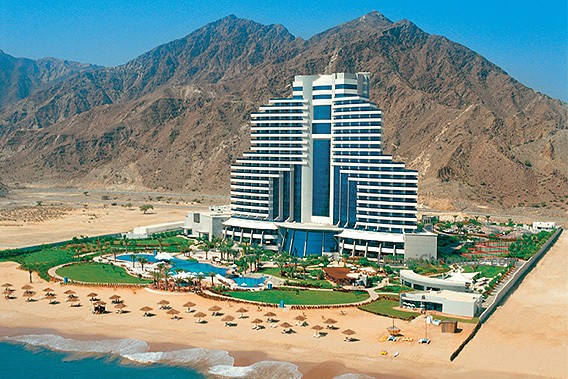

Property markets in London, Indonesia, China, Dubai, India, Monaco, US have been flooded with money. This excessive cash spending comes mostly from from Russian, Middle Eastern and increasingly European investors. This trend can be attributed to concerns about the potential devaluation of assets in European cities. This is a direct respond to a possible euro break up, which will lead to overpriced real estate.

Property could give the highest returns, many believe. Though, the true evaluation is driven not by real demand. It is rather caused by price speculations and hoarding in major regions where supply is rigid.

These days few assets are yielding decent real returns and even fewer promisse long-term stable income. Therefore, real estate is being reconsidered by many investors as a sound long term investment.