As the GCC economy slows down due to declining oil prices, an important question presents itself: Where is the GCC money going?

Even though there is no one definite answer, a good portion of the GCC wealth is being injected into real estate, particularly in the UAE. Globally, many HNWI are including more residential properties in their portfolios particularly those of top tier cities like London and New York. HNWI often view this asset class a safe investment one that secures wealth transfer from one generation to another. However, this traps them in a different problem: lack of diversification, which in a fluctuating real estate market could mean a greater risk of loss than not. A step towards a more diversified portfolio would be investing in second – tier cities where lucrative opportunities are more available as the global market recovers from the past financial downturn.

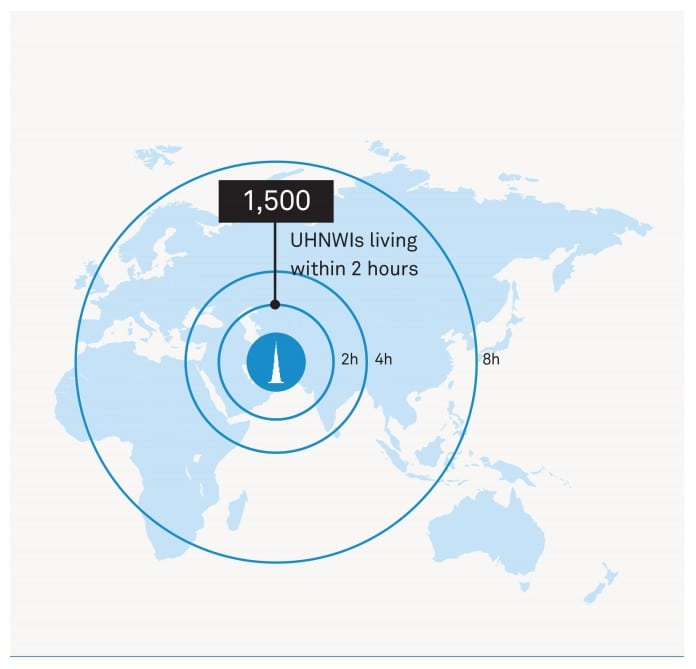

After years of considerable growth in the number of wealthy around the world, we are entering a period of deceleration as China’s economy slows and commodity-exporting, emerging economies are hit by lower prices and demand. The number of newly wealthy will slow, and UHNWIs will find it harder to grow their wealth. At the same time, the recent boom in wealth has heightened scrutiny on this group, not least as regards to tax. And with low interest rates around the world, and increasing life expectancy, retirement has become much more costly, increasing the challenge for UHNWIs to maintain and pass on wealth. In spite of these issues, philanthropy amongst the ultra-wealthy is at an all-time high and continues to grow. The ultra-wealthy are also increasing their asset allocation to passion investments such as fine art, and second homes overseas, enabling them to enjoy their wealth.”

The results of this year’s Attitudes Survey from the 2016 edition of the Knight Frank Wealth Report, highlights how important the next decade will be for UHNWIs and their advisors. Wealth creation is expected to slow, which, combined with an uncertain economic outlook around the world, will require new investment and wealth management strategies. However, judging by the sentiment of the survey’s respondents, property will remain an important part of UHNWI investment portfolios.