Those betting on emerging markets (EMs) to outperform have often been disappointed. Despite strong growth and supportive demographic and consumer trends, EM equity returns have only averaged +3.6% per year from 2010 to 2019.

But 2020 was different: The MSCI Emerging Markets Index outperformed the S&P 500 for the first time since 2017 (EM gained +18.5% versus the S&P 500’s +18.4%). And, Asian emerging markets were the best-performing equity markets globally, with China, Taiwan and Korea all up around +40% on the year (in U.S. dollar terms).

So was 2020 an anomaly, or was it the start of a longer period of outperformance for emerging markets? J.P.Morgan private bank analysts think there are three key things to consider in answering that question.

1) Emerging markets tend to do well when global trade is improving, commodity prices are resilient, and the U.S. dollar is weak.

In terms of trade, let’s get a gauge for how EMs might perform, exports and commodity prices give us insight. Exports are often the most volatile part of the EM growth cycle, and matter a lot for corporate earnings and for economies’ currencies—more trade tends to lend itself to higher profits and a stronger currency.

And although commodities now only account for 30% of EM exports (far less than in years past), commodity prices tend to reflect global growth. Said another way: When the world experiences broad-based growth, commodities tend to do well (think: more production, trade and travel). Commodity prices also tell us a lot about risk appetite and have been highly correlated with performance of EM (as a risk asset class).

In regard to the dollar, many EMs tend to hold dollar-denominated debt, and a weaker dollar makes such countries’ debt servicing costs more manageable (and provides a boost to growth). Commodities are also priced in dollars—when the dollar weakens, commodities become cheaper in other, non-dollar currencies, and demand for commodities tends to rise.

Turning to 2021, as the global healing process marches on, J.P.Morgan analysts expect EM exports to rebound, commodity prices to leg higher, and the U.S. dollar to weaken modestly—all factors that lead us to favor EM this year.

2) Country fundamentals

“Emerging markets” is a pretty broad term, covering over 20 countries from Latin America to Eastern Europe, to Asia. There tend to be two clear camps of emerging markets: 1) the commodity bloc, and 2) the manufacturing bloc. Both have very different characteristics and macro drivers.

The manufacturing bloc broadly consists of Asia, Central and Eastern Europe, and Mexico, and it tends to move in tandem with developed markets’ economic cycles and with global equities.

The commodity bloc largely consists of South America, Africa, Russia and the Middle East, and tends to offer more diversification and more exposure to strong cyclical growth. These EMs could do well on the expectation of more U.S. fiscal stimulus, especially in infrastructure.

Investors in EMs should take care to understand these differences. There are opportunities and diversification benefits of investing in certain segments of both.

3) “New economy” markets are thriving.

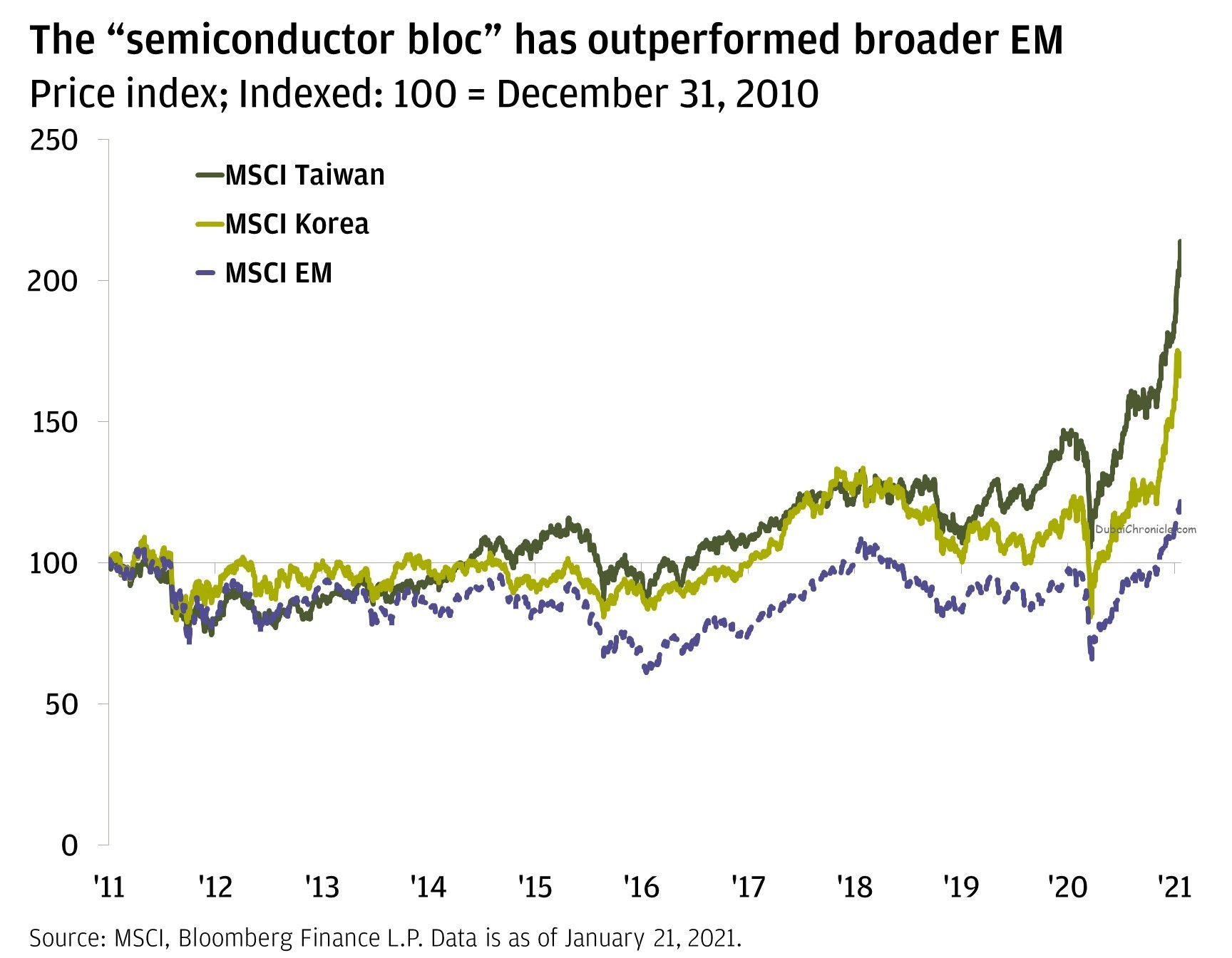

A new, third bloc is emerging: the semiconductor bloc, notably Korea and Taiwan. Semiconductors are the backbone of digital evolution; they’re in everything from your smartphone to electric vehicles. These two economies once moved in tandem with global trade, but as semiconductors have developed into the world’s most significant products, their markets have been more driven by the semiconductor demand cycle. The COVID-19 crisis accelerated our move to a digital economy, and we think this megatrend is here to stay.

Putting it all together, J.P.Morgan analysts come to the conclusion that emerging markets are our top trade idea for 2021. A still-improving global economy, robust demand for technology, strong virus containment, a modestly weakening U.S. dollar and a more predictable path for U.S.-China tensions all strengthen our outlook for EM to outperform this year.