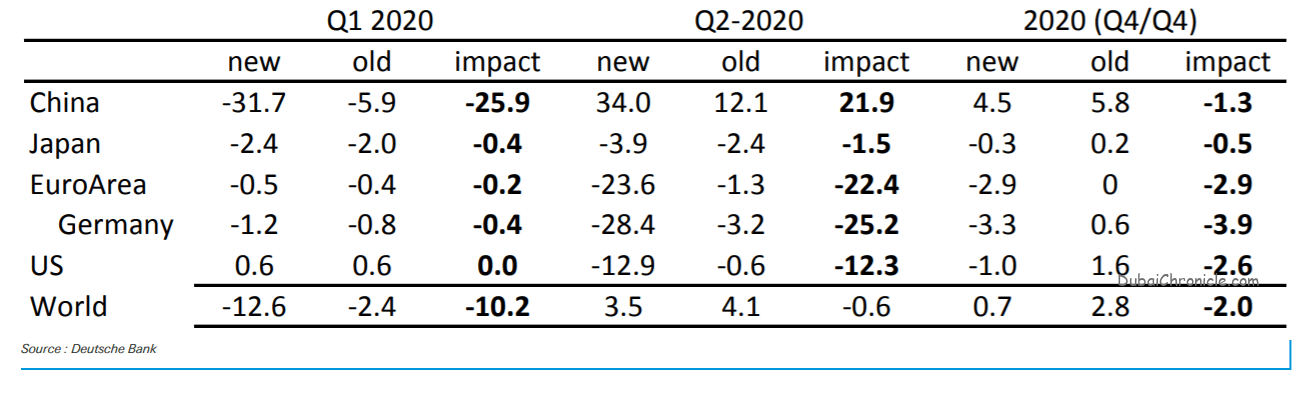

A new research note from Deutsche Bank says that in the first half of 2020 the world will experience a “severe global recession”.

Also according to S&P Global, the coronavirus outbreak has plunged the world’s economy into a global recession. The credit-rating agency, which determines the credit worthiness of governments and companies around the world, said that the virus has severely disrupted economic activity. It appears far more drastic than previous estimates. S&P said the damage to economic activity is about to get worse in United States and Europe.

Aggregate demand is plunging in China in the first quarter, and will plunge in the euro-area and the United States in the second quarter.

The note from Deutsche Bank’s economics team stated: “We now have early evidence of the negative economic impact on China and it has been far in excess of our initial projections. This, among other factors, including more widespread and draconian containment measures to deal with the spread, the emergence of strain in credit markets, and sharp tightening of financial conditions have caused us to revise down substantially our global growth forecasts in the first half of the year.”

In China, the Deutsche Bank team says the economy fell at about a 9% quarterly rate or 30% annual rate in the first quarter.

Deutsche Bank is now forecasting euro-area GDP to plunge at a 24% annual rate in the second quarter and 13% drop in the U.S. Such declines are unprecedented, as the previous record quarterly drop for the U.S. was 10% in the first quarter of 1958.

Deutsche Bank is now forecasting euro-area GDP to plunge at a 24% annual rate in the second quarter and 13% drop in the U.S. Such declines are unprecedented, as the previous record quarterly drop for the U.S. was 10% in the first quarter of 1958.

The positive news is that the forecast is still for a brief recession, dependent on how successful shutdown efforts are. “But we expect less than a full payback even after factoring in the impressive scale of fiscal and monetary ammunition that is being (and likely to be) brought to bear,” the Deutsche Bank team said.

The situation of course could get worse. The Deutsche Bank forecast is dependent on the idea “the severe containment measures being taken will succeed in flattening the epidemic curves by midyear” and that there will be a V-shaped recovery.

The situation of course could get worse. The Deutsche Bank forecast is dependent on the idea “the severe containment measures being taken will succeed in flattening the epidemic curves by midyear” and that there will be a V-shaped recovery.

“It is easy to imagine a still worse outcome,” they said.

Elsewhere in the US, Morgan Stanley’s team said a worldwide recession is now its “base case,” with growth expected to fall to 0.9% this year.

At Goldman Sachs, economists predict a weakening of growth to 1.25%.

Such slumps would not be as painful as the 0.8% contraction of 2009, as measured by the International Monetary Fund, but they would be worse than those of 2001 and the early 1990s. Both Morgan Stanley and Goldman Sachs said while they anticipate a rebound in the second half, the risks remain of even deeper downturns.