Industrial vs. retail antithesis to continue; newer models to drive future office space demand

The Covid-19 crisis has accelerated several emerging trends for GCC’s real estate market, and introduced new structural drivers for the sector’s demand outlook. The contrast between demand for industrial and retail spaces is set to continue, and represent the strongest and weakest segments of the market respectively. Demand for industrial spaces will continue to be driven by ecommerce, 3PL logistics, pharma, vertical farming and cloud kitchens. On the flipside retailers prefer to expand via omnichannel strategies, as consumers prefer to engage with the brand through many routes, thereby impacting demand for retail real estate. We expect entertainment and F&B tenants to remain the main drivers of incremental demand for mall spaces within the region, as against demand from retailers witnessed in the past. Commercial office spaces will likely need to be transformed to absorb the newer flexible and hybrid office models to generate incremental demand. Office spaces could also be repurposed as data centers, as Covid-19 has expedited the move to digital infrastructure for industries that are major users of technology and financial services.

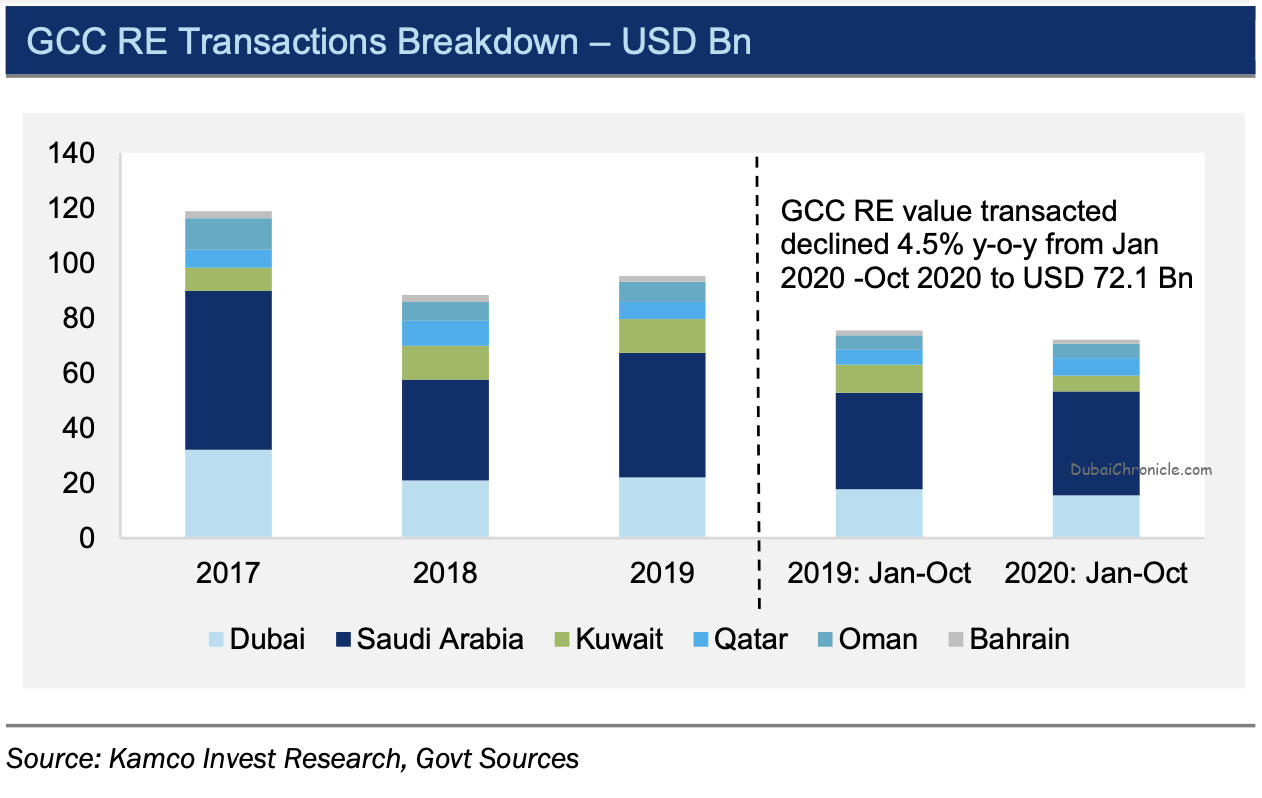

Recovery in 2021 will depend on both cyclical and structural catalysts: Real estate sale transactions in the GCC declined YTD at the end of Oct-2020 from a year ago, as total value transacted receded by 4% y-o-y to USD 72.1 Bn, from USD 75.5 Bn in the same period in 2019, while transaction volumes fell by 11% y-o-y over the same period. The signs of transactions bottoming out witnessed in 2019 will now be prolonged further into 2021, until normalized demand conditions arrive post-Covid. We do expect the supply-side to tighten cyclically in 2021, in terms of lower number of upcoming project announcements from developers, which should aid in arresting the ongoing steep declines of prices and rents. However, we believe structural catalysts would be required to cater to changing demand trends within each sub-segment of the real estate market. The residential segment looks to be the closest to a late-cycle recovery in rents and prices aided by government support. The segment also has fewer number of structural issues to cope with, barring fundamentals directly impacting the segment such as job creation.

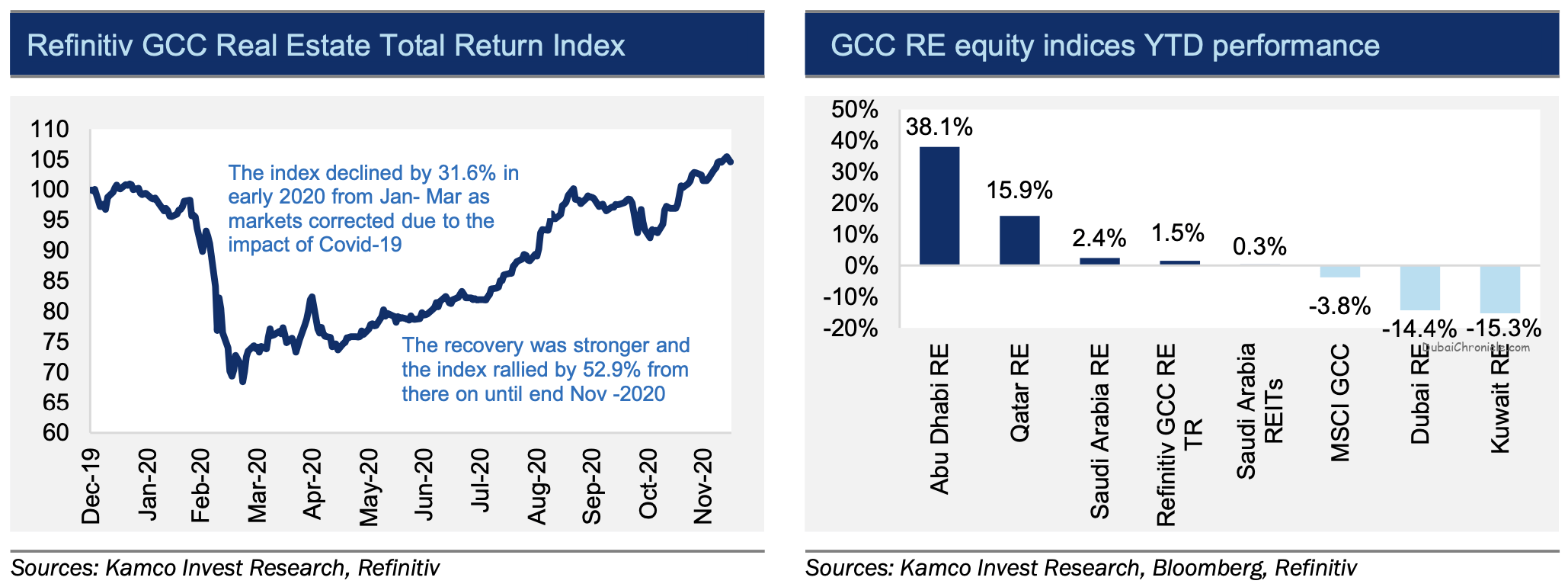

Equities, REITS performance to remain security specific: Real estate public securities recovered YTD by the end of Nov-2020 along with broader markets from the lows of Mar-2020. The Refinitiv GCC Real Estate Total Return Index declined by 31.6% from Jan-2020 to 23 Mar-2020 from the global sell-off, but more than recovered by the end of Nov-2020, ending marginally in the green on a YTD basis. Developers in the region are reconsidering certain key projects in the light of the current weak demand environment and making supply-side adjustments, which should help in providing cyclical stability for the sector. We expect performance to remain stock specific for real estate linked securities in 2021, as the market focuses on project IRRs and cashflow visibility in the near term. Over the medium-term, a re-rating of the sector would depend on the demand outlook, which would need to improve from aforementioned structural adjustments.

Recovery will require structural transformation

Real estate sale transactions in the GCC from Jan 2020-Oct 2020 declined from a year ago, as total value transacted receded by 4% y-o-y to USD 72.1 Bn, from USD 75.5 Bn in the same period in 2019, according to KAMCO’s estimates. Saudi contributed to over 52% of the value transacted, while UAE added 21.6% to the region’s aggregate figure. However, the average value per transaction in the GCC increased by 7.6% y-o-y to around USD 166,105 over Jan 2020-Oct 2020 from around USD 154,365 in the same period in 2019. The number of transactions YTD until Oct-2020 fell by around 11% y-o-y to 434,158. The lower y-o-y transaction volumes and value transacted was largely due to the impact of Covid-19 on real estate demand and its various sub-segments. Moreover, the signs of a bottoming out of transactions witnessed in 2019 will now be more prolonged into 2021 in KAMKO’s view, until normalized demand conditions arrive in a post-Covid environment.

In Dubai, the contribution of off-plan transactions from Jan 2020-Oct 2020 fell in terms of its contribution to both volumes and value transacted. The lower contribution by off-plan sales y-o-y in KAMCO’s view is ascribed to investors being more cautious to look at primary market opportunities for real estate investments, anticipating lower future prices. We believe a rebound in off-plan transactions and higher visibility for overall future transactions would be needed for confirming the beginning of the next real estate cycle. Separately, in country specific developments, Qatar issued a new law which added to the number of locations where non-Qataris can buy real estate along with a twotiered residency program that incentivized home ownership. This contributed to the higher number of transactions (+28%) and value transacted (+18%) y-o-y in our view over the first ten months of the 2020. We do expect supply in the GCC real estate market across various sub-segments to tighten cyclically in 2021 in terms of lower number of upcoming project announcements from developers, given the low demand environment prevalent currently, which should aid in arresting the ongoing steep declines of prices and rents. However, the Covid-19 crisis has accelerated several emerging trends for GCC’s real estate market, and introduced new structural drivers for the sector’s demand outlook. Newer catalysts would be required to cater to changing consumer habits and clientele within each sub-segment of the real estate market, mainly in the areas of digital communication and ecommerce. In terms of property sub-segments, the residential segment looks to be the closest to a late-cycle recovery in rents and prices aided by government support. The segment also has fewer number of structural issues to cope with, barring fundamentals directly impacting the segment such as job creation etc. Commercial office spaces will need to be transformed to absorb the newer flexible and hybrid office models, in order to generate incremental demand. Office spaces could also be repurposed as data centers, as Covid-19 has expedited the move to digital infrastructure for industries that are major users of technology and financial services. The contrast between demand for industrial and retail spaces is set to continue, and represent the strongest and weakest segments of the market respectively over the near term.

Residential affordability intensifies with Covid-19

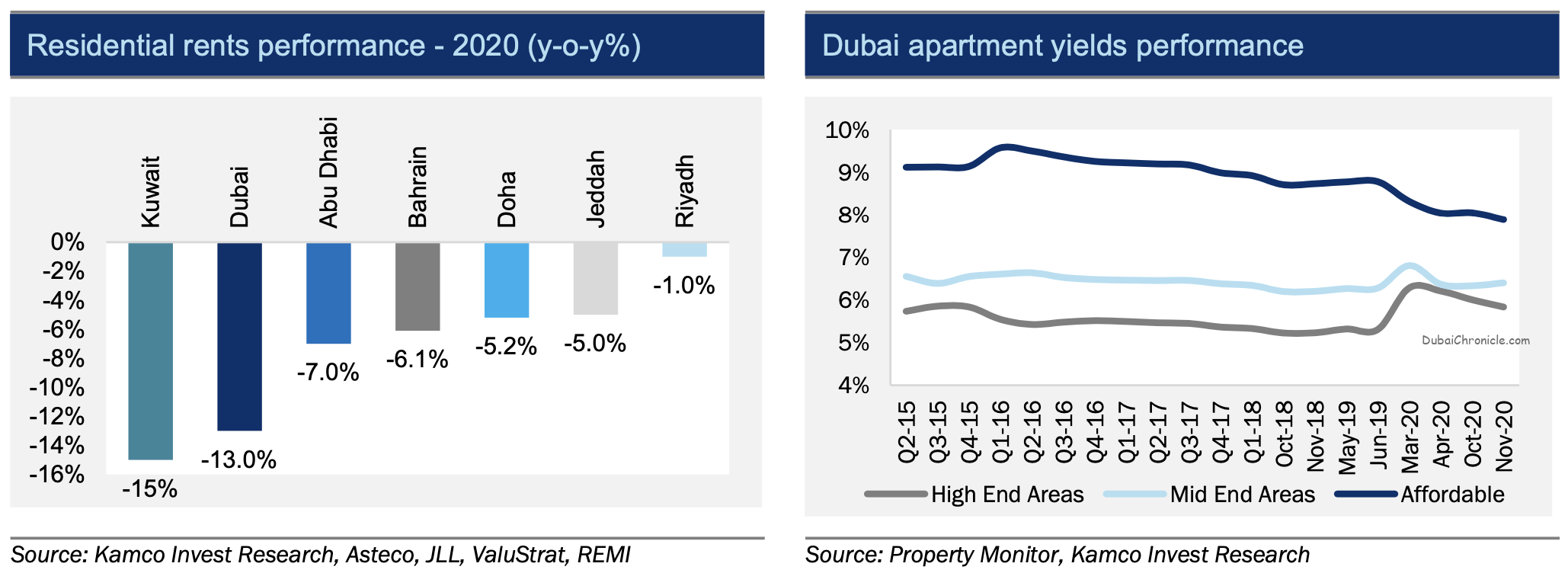

Covid-19 has caused additional headwinds for end-user demand in GCC’s residential real estate segment, driving rents and prices lower on a y-o-y basis in 2020, despite limited supply addition and several government initiatives for home ownership being rolled out. Rents in all residential markets were under pressure in 2020, as tenants continued to downsize, migrate to more affordable residences, or looked for more incentives in their existing tenancy contracts. In terms of residential prices, sales prices in Riyadh grew 2% y-o-y at the end Q3-2020, as per JLL, driven by the positive sentiment and momentum witnessed in the mortgage market from the Saudi government amending the 15% VAT on property transactions. Separately, Qatar issued a new law which will add to the number of locations where non-Qataris can buy real estate. A two-tiered residency program that rewards large investors with government-provided services was also introduced to incentivize home ownership.

The decline in rents was higher than the fall in prices during 2020, as some sellers preferred to defer the sales of residential apartments and villas in order to achieve higher prices in the future. As a result, yields compressed by end-2020 due to the higher decline of rents, and lower sales transactions, both in the resale and the off-plan market. Based on our analysis of Property Monitor data, all classes of apartment localities from high-end to affordable witnessed a yield compression of close to 40 bps from Mar-2020 to Nov-2020.

Looking ahead, the residential market is expected to remain under pressure until segment fundamentals such as number of households, employment rates improve. Moreover, we expect developers to continue offering a range of incentives such as fee waivers, discounts and rent-to-own agreements, combined with home finance options to attract new investors looking to take advantage of the lower prices.

Newer models to drive future office space demand

Incremental office space demand in the GCC was historically driven by job creation fueled by nonoil economic growth, with the average office space occupied per employee ranging from 15 sq.m 16 sq.m. While fundamental drivers have not changed significantly, the implementation of cost reduction and downsizing has led to office space optimization by corporates which has reduced the growth of incremental office space demand below estimates of upcoming supply. This has led to drops in office rents along with landlords being forced to provide incentives related to payment terms. Existing tenants continued to seek more attractive lease terms and migrate their office spaces.

With the onset of Covid-19, rents continued to fall across major office markets in the region, with more fragmentation apparent within each market. Although the weakness in rents was apparent market wide, select Grade-A spaces witnessed achieved higher rents, as their rents on prior contracts were below-market. Further, structural changes have occurred to the office space demand landscape, which has led to increased demand for flexible offices, growth in remote working, working from home (WFH) and hybrid office models. Moreover, corporates prefer to stay asset light and engage in sale and lease back transactions. Demand for the flexible office space market which was dominated by start-ups and SMEs is now reportedly witnessing significant contribution from mainstream corporates, who prefer to lease as against own office spaces, with the aim of reducing capital costs. Another hybrid model which is increasingly seen from operators of flexible office spaces combines standardized long-term contracts and co-working spaces. The hybrid model diversifies revenues sources for landlords, and keeps office spaces viable for both longer- and shorter-term sources of demand. Dubai remains the largest market for flex-office spaces in the GCC and the MENA region, as supply has more than tripled from 50,000 sq m in 2014, to almost 160,000 sq m by mid-2020, contributing to close to 2% of the total office stock, as per JLL. Office space operators in other markets in the GCC could follow the trend and allocate a higher portion of their office space lettings for flex and hybrid office spaces, owing to the increased government support for SMEs and flexibility required by main-stream corporates.

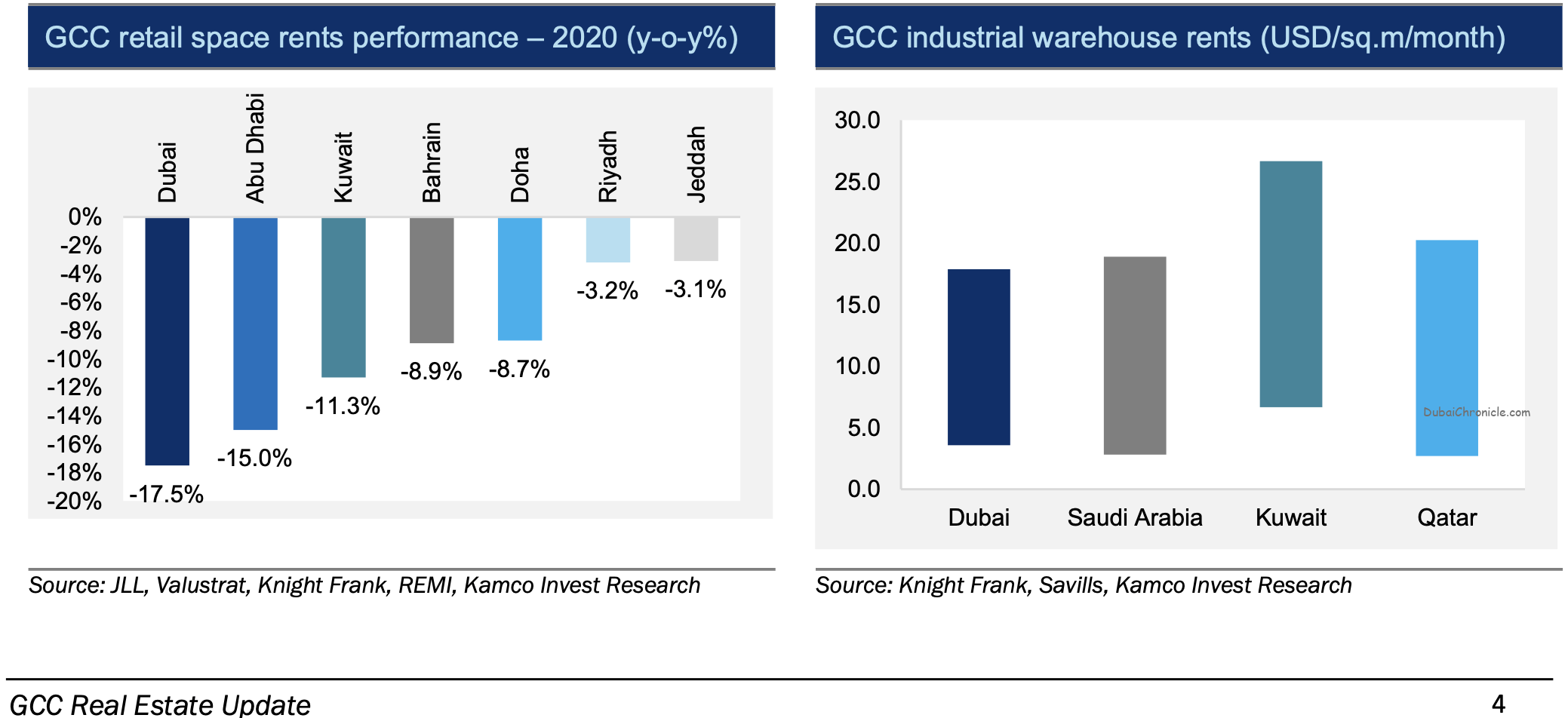

However, strong demand has resulted in higher supply coming into the market, which have made rents more competitive across storage types, and in some cases led to marginal rental declines as landlords look to gain market share. Nevertheless, prime GCC industrial yields still remain strong at 7%-8% making them the preferred segment for GCC real estate exposure. Moreover, demand emanating from e-commerce, 3PL, pharma, and FMCG especially from large hypermarkets will continue for automated build-to-suit, temperature-controlled and chilled centers. Retail rents in the GCC have corrected by double-digit or high single-digit percentages in 2020, as retailers demanded for a restructuring of tenancy deals, bargained for additional rent-free periods, and sought the introduction of turnover rents. The ongoing theme of changing consumer spending habits combined with lower brick-and-mortar footfalls and sales conversions continued during the year. Moreover, retailers are driving expansion plans via omnichannel strategies as consumers prefer to engage with the brand through many routes. Apart from the physical store, website and apps, strategies employed by retailers include marketplace presence, selling on social media and partnering with last-mile delivery services. The opposing trends witnessed in industrial and retail are largely on account of retailers resorting to the aforementioned omni-channel strategies. Post Covid19, KAMCO’s continue to expect entertainment and F&B tenants to drive incremental demand for mall spaces within the region, as against demand emanating from retail tenants. This trend should continue, given the limited number of entertainment alternatives available to residents in the GCC.

Industrial vs. Retail antithesis continues

In our earlier GCC Real Estate Update – Déjà vu or Different this time?, we highlighted industrial warehouses to be the strongest segment in the GCC real estate, with structural and cyclical trends favoring demand for spaces tailored towards unique storage needs. The newer sources of demand growth came from e-commerce and 3PL logistics, pharma, vertical farming and newer F&B models such as cloud kitchens. However, strong demand has resulted in higher supply coming into the market, which have made rents more competitive across storage types, and in some cases led to marginal rental declines as landlords look to gain market share. Nevertheless, prime GCC industrial yields still remain strong at 7%-8% making them the preferred segment for GCC real estate exposure. Moreover, demand emanating from e-commerce, 3PL, pharma, and FMCG especially from large hypermarkets will continue for automated build-to-suit, temperature-controlled and chilled centers.

Retail rents in the GCC have corrected by double-digit or high single-digit percentages in 2020, as retailers demanded for a restructuring of tenancy deals, bargained for additional rent-free periods, and sought the introduction of turnover rents. The ongoing theme of changing consumer spending habits combined with lower brick-and-mortar footfalls and sales conversions continued during the year. Moreover, retailers are driving expansion plans via omnichannel strategies as consumers prefer to engage with the brand through many routes. Apart from the physical store, website and apps, strategies employed by retailers include marketplace presence, selling on social media and partnering with last-mile delivery services. The opposing trends witnessed in industrial and retail are largely on account of retailers resorting to the aforementioned omni-channel strategies. Post Covid19, we continue to expect entertainment and F&B tenants to drive incremental demand for mall spaces within the region, as against demand emanating from retail tenants. This trend should continue in our view, given the limited number of entertainment alternatives available to residents in the GCC.

RE equities performance to remain stock specific

Real estate equities recovered by the end of Nov-2020 along with broader markets from the lows of Mar-2020, as global equities witnessed a massive sell-off driven by the impact of Covid-19. The Refinitiv GCC Real Estate Total Return Index declined by 31.6% from Jan-2020 to 23 Mar-2020, but more than recovered YTD, ending marginally up by the end of Nov-2020. Real estate equities in Abu Dhabi (+38.1%) and Qatar (+15.9%) were top performers, while real estate indices in Kuwait and Dubai underperformed.

Regional equity indices linked to real estate did witness sharp index moves, but in most cases, the performance was driven by stock-specific large cap names that single-handedly impacted the sectoral index. The YTD performance of the RE index in Abu Dhabi was buoyed by a 40.1% rally in the share price of Aldar. Developers in the region are reconsidering certain key projects in the light of the current weak demand environment and making supply-side adjustments, which should help in providing cyclical stability for the sector. We therefore expect performance to continue to remain stock specific for RE linked securities, as the market focuses on project IRRs and cashflow visibility, Over the medium-term, a re-rating of the sector would depend on the demand outlook, which would need to improve from aforementioned structural adjustments.