Positive oil-related triggers needed to sustain recent upswing

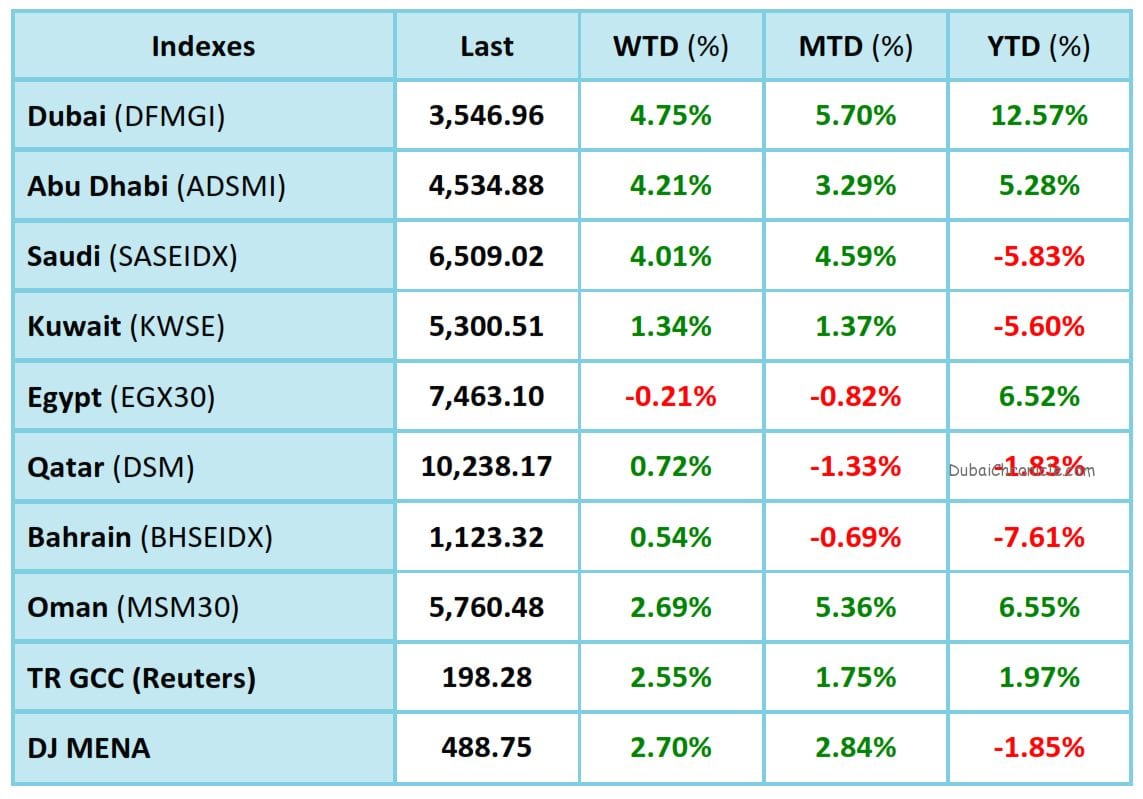

After a one-week break, buyers reasserted themselves pushing regional markets, especially those GCC, back in the black, according to Al Masah Capital’s Weekly Investment Report. With the support of oil remaining above $40, buyers came back into the markets and refocused on names that had driven the recent rally. Dubai, Abu Dhabi and Saudi led the way with 4.7%, 4.2% and 4.0% gains respectively.

Qatar continues to consolidate with a week of no gains while Egypt saw more profit-taking with a small weekly decline of 0.2%. On average, regional markets gained a healthy 2.3%, putting April in a strong position to deliver another positive month and extend this recent upswing.

“To continue this momentum, market participants need a steady diet of positive triggers and it helps if they are oil-related. They will get one this week as OPEC meets in Doha to decide on a production freeze. The ramifications of any deal could have meaningful impact on the markets. OPEC through a combination of posturing, talks and actual action have managed to not only out a floor on the price of oil but may have managed to create a new trading range,” the report noted.

If in six months, the actual demand-supply picture has changed significantly as it is being projected, then the recent lows may turn out to be permanent, Al Masah research experts predict. However, the question will then become how the high-cost producers respond because so far OPEC and its low-cost producing partners have done enough to not only change the dynamics but also the narrative.