Last week, Dubai once again announced a new mega-project, called Mall of the World. It will comprise of the largest shopping mall worldwide, hotels and shopping streets. Requiring a massive investment of $6.8 billion, the ambitious project together with the potential overbuilding is raising concerns about the risks of repeating the 2009 property market crash scenario.[wpsr_linkedin]

The emirate keeps announcing a large projects one after another in preparation for mega events in the region, notably World Expo 2020 as well as Qatar’s World Cup in 2022. The UAE, led by Dubai, is the most attractive country for major projects. The spending on capital developments is rising fast, which is not surprising, but financial experts are seeing warning signs that Dubai may not have the capacity to deliver all projects. Despite the economic growth, estimated around 4.5% for the coming years, the creditworthiness of the government and the generally positive outlook, the emirate is at risk of experiencing difficulties securing funding and paying the massive dept. And the huge number of projects still in development may lead to oversupply if the increase in demand doesn’t progress as predicted.

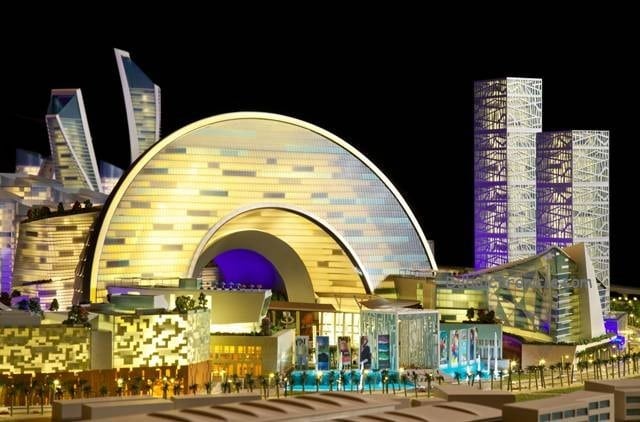

The latest project, unveiled last week by Dubai’s ruler Sheikh Mohammed bin Rashid al Maktoum, can be easily described as the biggest and most ambitious project so far. Temperature-controlled, the 4.8 million square meter development Mall of the Word, will comprise of the largest shopping mall in the world (currently, this is the Dubai Mall) as well as of a cultural district and a theme park. Shopping boulevards will also be climate-controlled to ensure the steady flow of tourists even during the hot summer months. Dubai Holding, the developer of the project, will also build 100 hotels and serviced apartments with 20,000 rooms to meet the increasing demand from the tourism.

However, there is a constant strong supply of residential and commercial properties in the emirate, with new buildings and hotels being opened every month. Only on Booking.com the number of hotels in Dubai surpasses 600. Some of the largest developments planned are Mohammed Bin Rashid City, which will have some 100 hotels, Nakheel’s project on Deira Islands with 23,000 rooms and the Expo site, which will also add thousands of rooms by 2020. The flow of people and businesses is still strong, but experts believe this won’t continue for much longer, considering the raising property prices and rents and the increasing cost of living. Recently, the international Monetary Fund warned that the fast recovery of Dubai’s real estate sector leads to the risk of “unsustainable price dynamics and an eventual, potentially disruptive correction”. Even the government-initiated correction measures that have been taken are hardly able to cool down the market.

The indoor domed Mall of the World has currently a price tag of AED 25 billion ($6.8 billion), which according to Dubai Holding, will be delivered over a period of 10 years. Half of the funding is expected to come from internal resources, while the rest of the investment should be taken after selling and leasing some parts of the project, various partnerships, and through the debt market. But concerns are being raised from the government-related entities and their difficulties to repay their debts on time. In 2015, Dubai World will repay around $4.4 billion, but it is uncertain for 2018, when most of its $25 billion debt falls due and the repayment becomes much larger. So, the possibility of extending the 2018 payment maturity was discussed with top creditors, says BofA. Dubai Holding itself is also facing challenges in the near future – one of its subsidiaries, Dubai Group, signed a deal in January for a $10 billion debt restructuring with creditors. The developer was one of the corporations that borrowed from banks during the 2006-2008 boom years and was hit hard by the property bubble finally burst.

Experts are warning that Dubai is currently at risk of repeating the history. According to the IMF, Dubai state-linked entities will have to repay debts of more than $92 billion over the next five years. Measures are needed to counter property speculation and to avoid overbuilding, Dubai should act timely limiting the long delivery lags of some developments, limiting the price growth, and many more.