Restrictions by the United States and others may lead sovereign wealth funds to invest closer to home instead of in the West, the head of the central bank for the United Arab Emirates was quoted as saying on Thursday.

According to a document in bullet-point form quoting UAE central bank governor Sultan Nasser al-Suweidi, such a scenario would trigger a “a new regional developmental cycle” in the Middle East.

“Regulations regarding SWF might lead to … fund becoming more passive investment vehicle or change direction of investment flows,” according to the document, presented at a Japanese business conference held in Dubai.

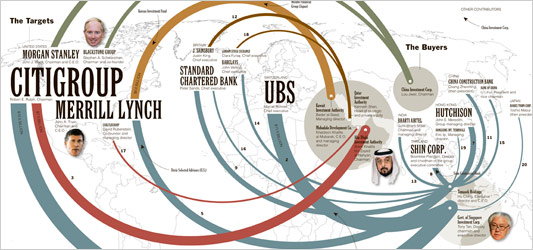

Sovereign wealth funds such as the UAE’s Abu Dhabi Investment Authority, the world’s biggest, have poured billions of dollars into ailing banks and firms in the industrialized economies in recent years.

But fears of foreign influence by the new stakeholders, whose wealth has mushroomed due to the high price of oil, has sparked an intense debate in the United States, Germany and elsewhere about curbing possible influence by the funds.

Reuters