However, the long-term investment outlook remains intact with even stronger fundamental indicators emerging highlighting that silver is heavily undervalued.

The gold-to-silver ratio continues to widen

One of these key fundamental indicators is the widening gold-to- silver ratio. This ratio essentially measures the amount of silver required to purchase an ounce of gold. It is an important indicator for determining how silver is valued relative to that of gold. Where the ratio is high it indicates that silver is undervalued relative to the ratio, meaning that investors should be choosing silver in preference to gold.

Over time this ratio has fluctuated wildly ranging between 16 ounces and 100 ounce of silver to purchase an ounce of gold, but it has an historic average of between 50 and 60 ounces of silver. At the time of the gold bull market when precious metals were in vogue because of growing fears of a sustained global economic meltdown, the ratio narrowed to requiring 38 ounces of silver.

However, as the bull market cooled the disconnect between the price of silver and gold continued with the ratio widening to 79 by end of 2015. Since then the ratio has widened even further too now require 80 ounces of silver to purchase an ounce of gold.

It is this which I believe indicates that silver is sharply undervalued in comparison to gold, making it a superior investment for those investors seeking precious metals exposure. While this ratio may only be a relative indicator there are also a range of fundamental indicators that show that silver is set to appreciate in value.

Demand for silver to grow strongly

One key advantage that silver has over gold is that it is a precious metal with considerable utility. This arises because of its use in a wide range of industrial applications that have a range of secular tailwinds that can only cause demand to grow.

Over 55% of the demand for silver comes from its use in industrial applications and this can only grow with it being a core ingredient in the manufacture of components for hi-tech electronics and solar panels.

Industrial demand can only grow with it predicted that silver consumption for use in electronics will rise tenfold over the next three years.

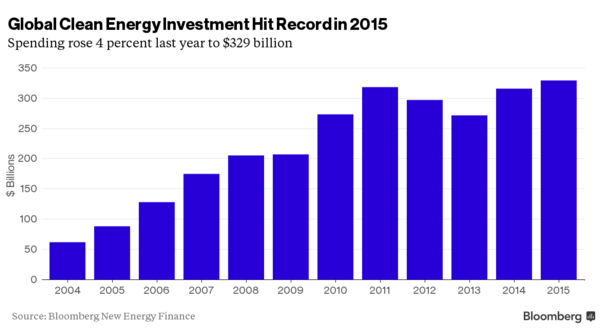

Then there is the secular trend to clean renewable sources of energy which has been a boon for the solar industry. In 2015 a record $329 billion was invested in renewable energy sources, more than 3 times higher than a decade ago.

This renewed interest in renewable sources of energy is a boon for silver because it is key element used in the manufacture of photovoltaic cells because of its highly conductive nature, with it being the most conductive of all the metals.

Now with a range of countries introducing aggressive renewable energy targets including a considerable proportion for solar, demand for silver for use in photovoltaic cells will grow exponentially. China which invested $110 billion in renewable energy in 2015 announced at the end of that year that it had quadrupled its solar target, seeking generate 200 gigawatts from solar by 2020.

This is almost an five times increase on its existing installed solar capacity of 43 gigawatts and with roughly 3 million ounces of silver required to manufacture sufficient photovoltaic cells to generate one gigawatt, there will be a sharp increase in demand for silver. Based on these numbers alone 468 million ounces of silver would be required to fabricate sufficient photovoltaic cells for China to achieve that target.

Countries other than China such as Brazil, Japan and India are also increasing their solar targets as well.

Growing supply concerns will support higher prices

Such a sharp increase in demand will trigger a supply shortage. This is because the commodities rout in conjunction with markedly weaker silver prices has triggered a significant decline in investment in silver mining. The largest supply of silver from mining comes from it being a byproduct of base metals mining.