Emphasis on building safety: 2016 will witness greater attention towards building safety from various stakeholders, including developers, landlords, occupiers, consultants and government agencies. Due to increased overall awareness, there will more demand for well-maintained buildings with better fire safety and other systems. The market will also witness new regulations where building owners will have to adhere to stricter fire safety guidelines from government agencies such as Civil Defence. The important need in 2016 is probably less for new regulations, but for more effective enforcement of the existing codes and regulations. This is likely to remain a hot issue as stakeholders seek to reduce the reputational risk to their brand from accidents and incidents relating to building safety.

Craig Plumb, Head of Research, JLL MENA concluded: “In a more challenging economic environment, real estate stakeholders (including investors, developers, occupiers and the government) need to consider a range of new strategies to realign themselves and accept the new realities. Despite softening demand across many sectors of UAE real estate there remain significant opportunities for those willing to embrace the new trends offered by an increasingly mature and sophisticated market. It is also important to recognize that while the pace of economic growth in 2016 is expected to be below that seen in 2013 and 2014; it remains in line with that seen in 2015. The market may be slowing but it is still growing”.

The UAE remains an attractive real estate market and some buyers, especially owner-occupiers and those investors taking a long term perspective may well see value at current levels. Overall, we remain confident that while prices and rentals will soften further in the short term, they are likely to increase again, perhaps as soon as 2017, as the UAE continues on its’ path to becoming a more mature real estate market.”

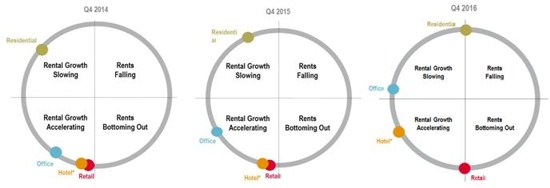

Dubai prime rental clock

This diagram illustrates where JLL estimates each prime market is within its individual rental cycle as at the end of the relevant quarter along with the forecast for the end of 2016.

Abu Dhabi prime rental clock

This diagram illustrates where JLL estimates each prime market is within its individual rental cycle as at the end of the relevant quarter along with the forecast for the end of 2016.

The low oil prices are showing an impact on the real estate market globally as it has direct and indirect effects on the economy. Although a low price for oil is always welcomed by consumers it has negative effects as many countries depend on oil as a major source of revenue.